Blog Details

Will Audemars Piguet Continue to Grow under New Leadership?

September 6, 2024

How new CEO Ilaria Resta can guide AP through a period of slower growth and free itself from dependence on the Royal Oak

In May 2023, Audemars Piguet announced that its CEO Henry Bennahmias, who had run the company for 11 years, would be replaced by Ilaria Resta. As an outsider in the watch industry, Resta was not an obvious pick. The chief executive had previously worked for Procter & Gamble and Firmenich, a family-owned fragrance business. When she took over from Bennahmias in January, Resta became one of only two CEOs currently running a major luxury watch brand.

Despite her non-luxury background, Resta brings a significant amount of expertise to Audemars Piguet. In fact, her outsider status is more likely a positive rather than a negative. AP did not become one of the most successful brands in the industry by resting on its laurels. The company pioneered the luxury steel sports watch in the 1970s when quartz threatened Swiss dominance in watchmaking. As CEO of AP North America, Bennahmias began brokering collaborations with celebrities and Marvel, a daring strategy that has paid off. In the last decade, the brand started shifting away from traditional multi-brand retail, significantly decreasing points of sale and opening 15 new appointment-only AP Houses. A few years ago, the company opened a museum in Le Brassus and later finished a manufacturing site in Le Locle. More recently, AP made waves by collaborating with artists Travis Scott and John Mayer to create limited-edition versions of the Royal Oak Perpetual Calendar.

While bold moves like these have proved successful for AP, luxury watch brands are also chained to tradition. Heritage (or perceived heritage) is responsible for much of what gives a company prestige relative to its competition. In several interviews, Resta has said that she is not obsessed with growth and is committed to the traditions of the brand. Having come from Firemnich, she also has experience working for a family-owned business. Still, Resta must face the challenge of balancing the necessity of staying true to AP's heritage and daring to change. One way Resta can start is by decreasing the brand's reliance on the Royal Oak.

Growth and Royal Oak Dependence

According to Morgan Stanley's annual reports on the Swiss watch industry, Audemars Piguet has generated the fourth most turnover of any Swiss brand behind Rolex, Cartier, and Omega since 2021. In 2023, the company raked in an estimated 2.35B CHF, an approximate 10% increase over the previous year. AP consistently beats competitors Patek Philippe, Richard Mille, and Vacheron Constantin.

However, the watch market, which boomed during the pandemic, has been trending downward in recent years. Although resale prices of Royal Oaks have fallen significantly, demand for the model remains strong. For the average buyer, purchasing a Royal Oak directly from the brand remains close to impossible. Waitlists still swell with aspiring owners and most models sell for over retail, albeit not many multiples over retail as they did just a couple years ago. Still, Resta admitted to The New York Times that she's "entering at a moment where the market is going back to a more structural, organic type of growth."

Audemars Piguet may have another problem. The brand has long been criticized as a "one-trick pony" due to its reliance on the Royal Oak. The company made some fairly lackluster attempts to decrease that dependence by releasing the Code 11.59. That model was widely mocked upon release. In an interview with Revolution, Resta stated that the Code represents 12% of AP's business. But many view the Code 11.59 as a watch that aspirating Royal Oak owners buy to get in AP's good graces rather than a standalone model capable of bolstering the brand if the Royal Oak's luster ever diminishes.

It would hardly be controversial to say that AP's catalog lacks depth, especially when compared with those of its competitors. However, the brand has ample opportunity to amend this issue; AP's archives go back centuries and are replete with many illustrious designs thanks to its historical prominence in luxury watchmaking. Whether Resta will tap into those archives remains to be seen.

Bennahmias and Resta have also both spoken about placing greater emphasis on women's watches. Many luxury watch brands think of ladies' watches as downsized, subordinate versions of important models for men. Cartier's ability to appeal to the female market segment is a large part of why the company is the second-most successful Swiss watchmaker by turnover. Resta highlighted the demand for jewelry and more complicated watches in her Revolution interview, and she called the female segment "underserved" in an interview with Monochrome. The company has already taken action to amend this issue. AP introduced a smaller size of the Code 11.59 last year and debuted the Royal Oak Mini, a 23mm quartz watch, in May.

Closing Thoughts

In her Monochrome interview, Resta said that she is "arriving at a pivotal moment when the market is changing." The company is undoubtedly very healthy. By targeting the underserved female segment and shifting the brand away from its dependence on the Royal Oak, Resta can do more than just follow in Bennahmias' footsteps. AP has the potential to overtake Omega and rival Cartier; its new CEO might just be the one to do it.

Write a Comment

Recent Posts

5 Brand Revivals to Watch

September 26, 2024

Will Audemars Piguet Continue to Grow under New Leadership?

September 6, 2024

The 5 Best High-End German Watch Brands

July 30, 2024

A Guide to Seikos New Releases

July 1, 2024

The Battle to Make the Thinnest Watch

June 27, 2024

The Limited-Edition Zenith Defy Zero G Sapphire

June 27, 2024

Watch Industry Trends in 2024

June 3, 2024

The Best Attainable High Complications

June 3, 2024

The Best Sector Dial Watches at Every Price

May 24, 2024

How To Choose a Watch

May 24, 2024

A Guide to TAG Heuers Latest Glassbox Chronographs

May 24, 2024

A Guide to Rolexs Releases from Watches and Wonders 2024

April 16, 2024

The Best Releases of 2024 So Far

April 9, 2024

Blancpain Finally Releases the Fifty Fathoms in 42mm

April 9, 2024

The Omega X Swatch Snoopy MoonSwatch

April 3, 2024

H. Moser & Cie Pioneer Tourbillon Midnight Blue

March 28, 2024

The Best Luxury Alternatives to the Royal Oak and Nautilus

March 22, 2024

The Best Affordable Integrated-Bracelet Sports Watches

March 20, 2024

A Brief Introduction to Microbrands

March 20, 2024

Omega Launches a White-Dial Speedmaster

March 20, 2024

How Do Affordable Watches Generate Hype?

March 15, 2024

The New Piaget Polo 79

March 15, 2024

Unique Complications You Might Not Know

December 8, 2023

The F.P. Journe Octa Divine

December 8, 2023

A Guide to Leather Watch Straps

September 22, 2023

The Biggest Tudor News in 2023

September 22, 2023

Should I Buy Used Watches Online or In-Person? Pros and Cons

September 21, 2023

An Overview of Rolex's New Releases

April 18, 2023

The Best Luxury Field Watches on the Market

March 24, 2023

The Unexpected Redemption of the Code 11.59

March 14, 2023

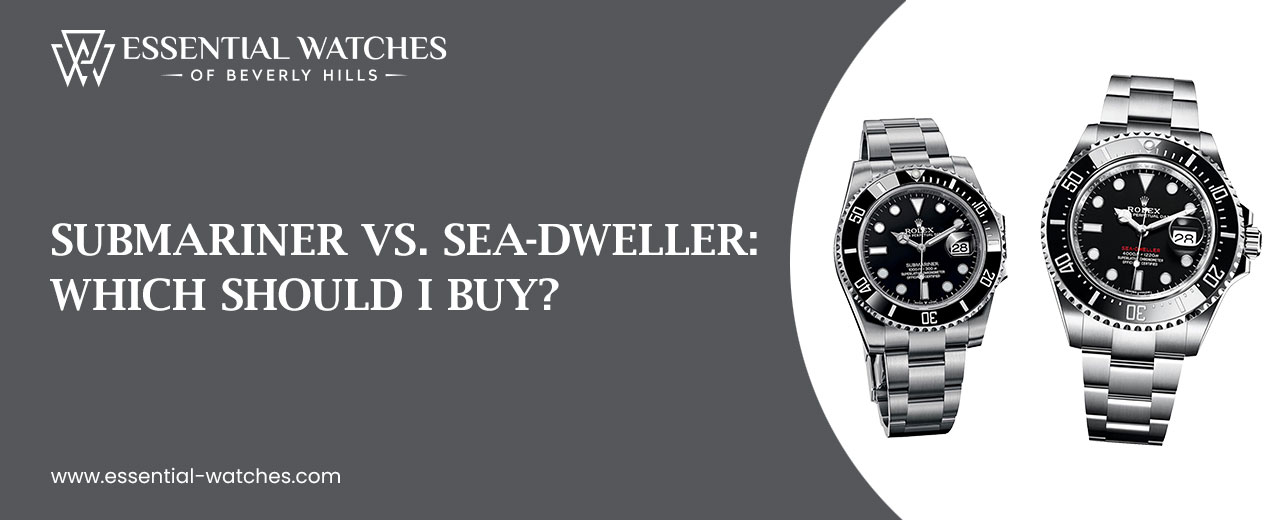

Submariner vs. Sea-Dweller: Which Should I Buy?

March 14, 2023

The Best of High-End Quartz

February 21, 2023

Watches from Movies and TV You Might Have Missed

February 10, 2023

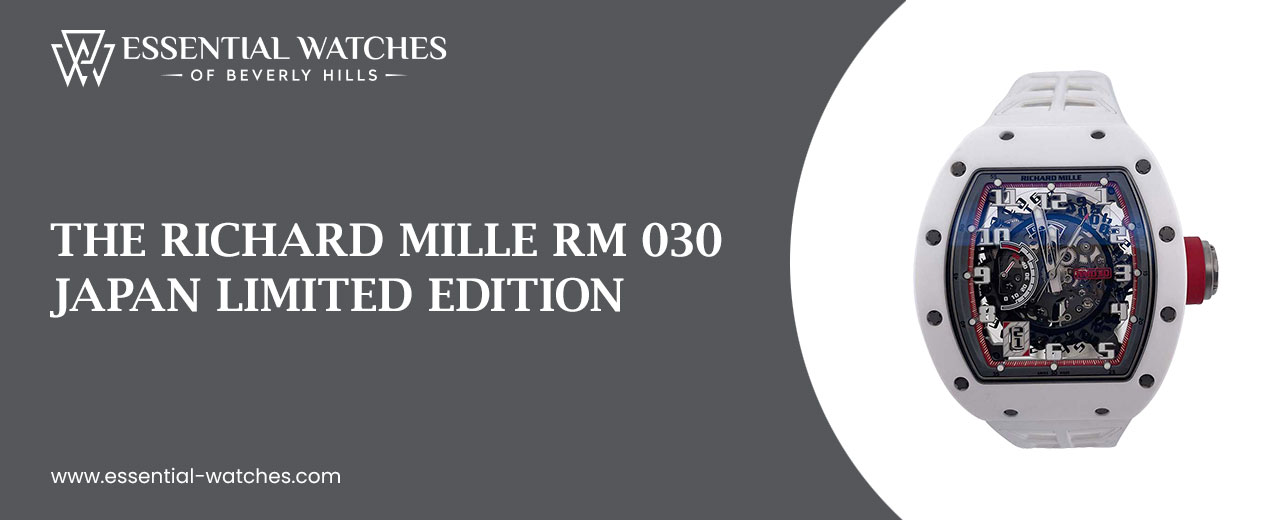

The Richard Mille RM 030 Japan Limited Edition

December 30, 2022

THE GREUBEL FORSEY BALANCIER S CARBON

December 7, 2022

Rolex Explorer Watches

October 8, 2015

Rolex Daytona Cosmograph

October 7, 2015

Rolex Air King Watches

September 8, 2015

Insane Watches Worn By the Rich And Famous

July 10, 2015

8 Best Luxury Watches For Travel

July 10, 2015

MONTRES BREGUET: REINVENTING THE SOUL OF HOROLOGY

May 12, 2015

0 Comments